Thursday, January 28, 2010

Monday, January 25, 2010

Uncertainty on Bernanke vote raises economic fears

But Bernanke's prospects appeared to brighten Sunday, with three more senators, including Republican leader Mitch McConnell of Kentucky, predicting he'll be confirmed. A vote is expected later this week.

Still, the chance of Bernanke's defeat has unsettled Wall Street, contributing to last week's 4 percent loss by the Dow Jones industrial average, its worst performance in 10 months. If Bernanke were rejected, uncertainty over a successor would further roil global markets, at least in the short run.

Thursday, January 21, 2010

Buffett predicts slow, uncertain economic recovery

Sunday, January 17, 2010

E*Trade Surges on Speculation of Acquisition Talks

The stock rose 6.4 percent to $1.84 in Nasdaq Stock Market trading after the Telegraph said the talks were advanced and the company has shut down applications for new accounts. E*Trade spokeswoman Pam Erickson said that the company shut down applications for international locales in connection with a previously announced restructuring and that it doesn’t comment on market speculation or rumors.

Tuesday, January 12, 2010

Investment outlook 2010

Think cautiously: hot money, asset bubble, inflation, policy exit, strong US$ ….

Global healing, not global boom

Global GDP had contracted by about 1% in 2009, the worst since 1982. Undoubtedly the world has started to heal in about June, and continues to bounce as China, Brazil, India and Southeast Asia are pulling relentlessly. While we believe the world will eventually heal all its deep-cut wounds caused by the financial turmoil of 2008, a full recovery is unlikely to be seen until the end of 2012. For 2010, we will have a global recovery, not a global boom. While the stock markets of Hong Kong and China are still in their party moods, we caution investors to think about the possible setbacks that will cause some really volatile swings for the markets.

Hot monies will depart

There were no sign of their departure so far, but if they do depart, the bull market will end without hesitation. There are plentiful profits with the hot monies already, so the lure to depart is irresistible. Besides, their flows are hypersensitive to the policy changes and shifting relative attractiveness of the different markets. As such, by nature they won’t stay.

Asset bubbles will burst

Many young doctor and lawyer lovers can’t afford to buy a shelter to get married. We will not see public land sales resuming. As such, property prices will continue to rise. The asset bubble will burst when all young couples are marching on the streets on 1st July 2010, or when the hot monies suddenly leave and cause the market to collapse.

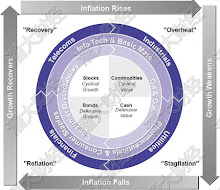

“Policy exit” here and there

Given the globe will reach the flexing point of its recovery path during 2010, the central banks must withdraw the excessive liquidity from the system. Their “policy exit” may take different forms, and start at different times. Yet the end result will be the same: interest rates will go up, so as the mortgages and borrowing costs. Only by doing so, the G7 (and to lesser extent, China) can curb inflation expectation before inflation runs. As the “policy exit” is equal to high interest rate, equity markets will head south when the politicians are heated up with the debates of when and how to exit, a signal telling the stock market to contract, in our view.

US$ strengthening

The US$ had declined by 10-20% against most Asian currencies in 2009, causing gold price to reach over US$1200. The US dollar index of the Reuters was 89 in Feb and is now 77. In 2010, the US$ will likely strength instead of continue to fall, the US economy will finally start to recover and the number of new jobs will rise. A stronger US$ will lift the appreciation pressure from the RMB, and will also induce a majority of the hot monies to flow back to the US, causing severe swings in the HSI.

Hot themes for the mid-caps

Obama Plans to Raise $120 Billion From Banking Fees

The White House hasn’t settled on the final structure of the fee and how to target the big banks that have returned to profitability, said the official, who requested anonymity.

The plan is to have revenue from the fee dedicated to deficit reduction and to cover the amount that the Treasury Department estimates it will lose from TARP, which is $120 billion. Details will be contained in the fiscal 2011 budget that Obama will submit to Congress next month, the official said.

Malaysia Palm Oil Stockpiles Second Highest on Record

Tuesday, January 5, 2010

Resorts World Sentosa

The chairman of the Genting Group and Resorts World Sentosa Tan Sri Lim Kok Thay said in a statement on Tuesday, Jan 5 that when the Genting Group won the bid to build Resorts World Sentosa in December 2006, it promised Singapore that it would deliver a true integrated resorts that would make Singapore and Singaporeans proud.

Resorts World Sentosa’s four hotels - Festive Hotel, Hard Rock Hotel Singapore, Crockfords Tower and Hotel Michael – offer a combined inventory of 1,350 rooms and 10 restaurant outlets at their opening.

Another two hotels at the Resort, Equarius Hotel and Spa Villas, will add another 500 rooms when they launch after 2010.

"Resorts World Sentosa is working closely with the authorities to obtain approvals for Universal Studios Singapore, which will open next. The opening date for the casino will be announced when it gets notice of its casino licence," it said.